2018年10月26日(パリ)

Organic growth at 4.3% for the nine-month period

Objectives confirmed

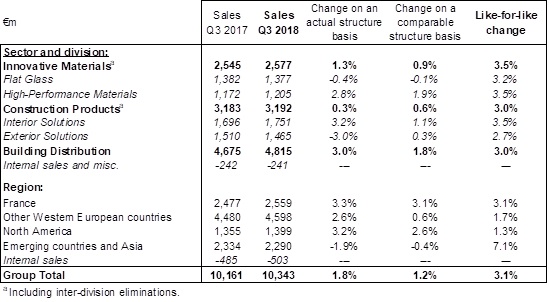

- Organic growth at 4.3% for the nine-month period and at 3.1% in Q3

- Negative currency impact of 3.6% over the nine-month period and of -1.9% in Q3; positive Group structure impact of 1.1% over the nine-month period and of +0.6% in Q3

- Acceleration in pricing, up 3.5% in Q3 (up 2.9% over the nine-month period) amid continued cost inflation

- Volumes slightly down by 0.4% in Q3 against a high comparison basis in Q3 2017

- 11.8 million shares bought back at the end of September 2018

- 2018 objectives confirmed

Pierre-André de Chalendar, Chairman and Chief Executive Officer of Saint-Gobain, commented:

“Saint-Gobain continues along its growth trajectory despite a tough comparison basis in Q3 2017. Our focus on increasing prices – critical in an inflationary environment – continues to pay off. The industrial issues that had weighed on our profitability in the first half of the year are largely behind us.

Saint-Gobain is therefore confirming its objectives for full-year 2018 and for the second half expects the like-for-like increase in operating income to be clearly above the level achieved in the first half.

The strategic initiatives announced in July are moving forward; they will help accelerate the Group’s profitable growth momentum. This new organization will be outlined in a specific announcement on November 26th.”

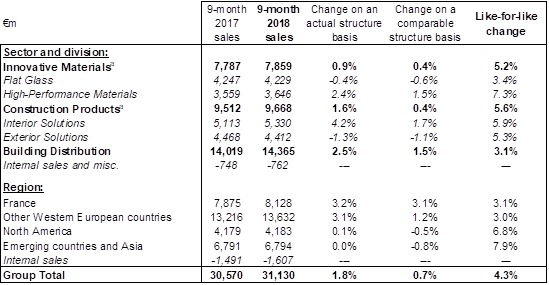

Consolidated sales for the first nine months of 2018 were €31,130 million compared to €30,570 million for the first nine months of 2017.

The negative currency impact was 3.6% over the nine-month period, with a smaller 1.9% negative impact in the third quarter resulting mainly from the appreciation of the US dollar against the euro, despite the ongoing depreciation of the Brazilian real, Nordic krona and other Asian and emerging country currencies.

The Group structure impact added 1.1% to total growth over the nine-month period, essentially reflecting the consolidation of acquisitions in Asia and emerging countries (KIMMCO, Megaflex, Isoroc Poland, Tumelero), in new niche technologies and services (TekBond, Scotframe, Maris, Logli Massimo) and to consolidate our strong positions (Glava, Kirson, Wattex, Biolink, SimTek, bolt-on acquisitions in Building Distribution such as Per Strand).

The smaller Group structure impact in the third quarter (+0.6%) reflects the acceleration in the Group’s portfolio optimization program, with in particular the disposal of the EPS insulation foam business in Germany and glazing installation operations in the UK. The Group has also launched a process to sell the legal entity of its Pipe business in Xuzhou, China. It should be noted that in light of the now hyperinflationary environment in Argentina, this country which represented less than 1% of the Group’s 2017 sales, is excluded from the like-for-like analysis as of July 1, 2018.

On a like-for-like basis, sales were up 4.3% over nine months and 3.1% in the third quarter. This reflects a further acceleration in pricing, up 3.5% after a 2.5% rise in the first half, in a context of continued raw material and energy cost inflation. Volumes were up 1.4% over the nine-month period, and remained almost stable in the third quarter (down 0.4%), affected in particular by a high comparison basis in High-Performance Materials and Exterior Products in the US.

Like-for-like performance of Group Business Sectors

Innovative Materials sales rose 5.2% over the nine-month period, including 3.5% in the third quarter.

- Flat Glass performed in line with first-half trends, reporting organic growth of 3.2% in the third quarter and of 3.4% over the nine-month period. The automotive business continued to enjoy good growth momentum, particularly in Asia and emerging countries, despite market disruptions relating to the introduction of the new automotive emission regulations in Europe. The recent capital expenditure and innovation investments continued to gather pace. Sales linked to the construction market continued along the lines of the positive trends seen in the first half in the Group’s main regions, driven in particular by a better mix effect and an acceleration in price increases for transformed glass in Europe. Following the restart of production at the float glass facility in Romania in the second quarter, production resumed in Poland and Egypt in September as expected, and India started up its fifth float line.

- High-Performance Materials (HPM) sales were up 7.3% over the nine-month period and 3.5% over the third quarter, with advances in all businesses. This slower pace of growth reflects the high comparison basis, especially in Ceramics, which had reported exceptionally strong sales in the prior-year period. Over the nine months all businesses and regions progressed.

Construction Products (CP) sales were up 5.6% over the nine-month period, including an increase of 3.0% in the third quarter.

- Interior Solutions delivered organic growth of 5.9% over the nine-month period and 3.5% in the third quarter, driven by pricing. Western Europe progressed slightly despite lower volumes in the UK. In North America, the acceleration in price increases in the quarter weighed on volumes. Asia and emerging countries reported good growth.

- Exterior Solutions sales rose 5.3% over the nine-month period and 2.7% in the third quarter, against a very high comparison basis in Exterior Products, which had been boosted by additional weather-related demand in the US in the third quarter of 2017. Despite a clear decline in volumes, Exterior Products implemented significant price increases in August. Excluding the Group structure impact relating to China, sales trends improved in the Pipe business, which is pursuing its restructuring program. Mortars progressed, particularly in Asia and emerging countries, despite uncertainties in Brazil.

Building Distribution like-for-like sales advanced at the same pace in the third quarter (3.0%) as in the first half, rising 3.1% over the nine-month period. France delivered a good quarterly performance, and the Nordic countries continued the good trends seen in the first half of the year. The UK reported further growth, still driven by a strong price effect despite declining volumes. Germany and Brazil were down over the third quarter.

Like-for-like analysis by region

- France enjoyed further good momentum in the quarter and over the nine-month period, with sales up 3.1%, benefitting from robust markets in new construction and renovation where growth remains nevertheless constrained by the lack of skilled labor.

- Other Western European countries progressed 3.0% over the nine-month period and 1.7% in the third quarter. Nordic countries continued to report a good pace of growth. The UK was up slightly thanks to sales prices but with declining volumes in an uncertain environment. Germany remained hesitant.

- North America climbed 6.8% over the nine-month period and 1.3% in the third quarter, against a very high comparison basis in Exterior Products and HPM. Construction and industrial markets remained robust.

- Asia and emerging countries continued to enjoy good momentum in the third quarter, up 7.1% (up 7.9% over nine months), reporting growth in all regions.

Strategic priorities and 2018 outlook

Saint-Gobain continued its pace of small and mid-sized acquisitions during the third quarter. Over the nine months to September 30, 2018, the Group acquired 17 companies for a total amount of €561 million. These acquisitions will enable Saint-Gobain to:

- consolidate its leading positions and unlock synergies (e.g. Per Strand in Norway);

- accelerate its growth in emerging countries (e.g. KIMMCO in Kuwait);

- acquire additional technological bricks to be combined with its portfolio of innovative solutions (e.g. HKO in Germany).

The additional strategic initiatives intended to accelerate the Group’s transformation are moving forward. They involve in particular:

- accelerating the renewal of the Group’s portfolio by the end of 2019 through divestments representing sales of at least €3 billion, resulting in a positive impact of around 40 basis points on the operating margin;

- defining a new organization closer to the markets, offering greater agility and unlocking more synergies. A specific announcement on this subject will be made on November 26, 2018.

The Group expects the following trends for the fourth quarter:

- a robust construction market in France, but which remains constrained by the lack of skilled labor;

- progression in other Western European countries, despite continued uncertainty in the UK and temporary disruption from the automotive market;

- growth in North America in both construction markets and industry;

- good momentum in Asia and emerging countries.

The Group confirms its action priorities for the year as a whole:

- its focus on sales prices amid continued inflationary pressure on costs;

- its cost savings program, with the aim of unlocking additional savings of around €300 million (calculated on the 2017 cost base);

- its capital expenditure program of around €1.7 billion (representing around 4% in sales, in line with our objectives), with a focus on growth capex outside Western Europe and also on productivity (Industry 4.0) and digital transformation, particularly in Building Distribution;

- its commitment to invest in R&D to support its differentiated, high value-added strategy;

- its focus on high levels of free cash flow generation.

Saint-Gobain confirms its objective for full-year 2018 of a like-for-like increase in operating income and for the second half expects the like-for-like increase to be clearly above the level achieved in the first half.

Glossary:

Organic growth and like-for-like changes in sales and operating income reflect the Group’s underlying performance excluding the impact of:

- changes in Group structure: indicators for the period concerned and those for the previous period are calculated based on the scope of consolidation for the previous period (Group structure impact);

- changes in exchange rates: indicators for the period concerned and those for the previous period are calculated using exchange rates for the previous period (currency impact);

- changes in applicable accounting policies.

Operating income: see Note 3 to the financial statements in the interim financial report, available by clicking here: https://www.saint-gobain.com/en/finance/regulated-information/half-yearly-financial-report

Free cash flow: cash flow from operations excluding the tax impact of capital gains and losses on disposals, asset write-downs and material non-recurring provisions, less capital expenditure.

Capital expenditure: investments in property, plant and equipment.

Financial calendar

- Announcement of the new organization: November 26, 2018, before open of trading on the Paris Bourse.

- 2018 results: February 21, 2019, after close of trading on the Paris Bourse.

|

Analyst/Investor Relations |

Press relations |

||

|

Vivien Dardel Floriana Michalowska Christelle Gannage

|

+33 1 47 62 44 29 +33 1 47 62 35 98 +33 1 47 62 30 93 |

Laurence Pernot Susanne Trabitzsch |

+33 1 47 62 30 10 +33 1 47 62 43 25 |

A conference call will be held at 6:30pm (Paris time) on October 25, 2018: dial +33 (0) 1 72 72 74 03 followed by the code 49602867#.

Important disclaimer – forward-looking information:

This press release contains forward-looking statements with respect to Saint-Gobain’s financial condition, results, business, strategy, plans and outlook. Forward-looking statements are generally identified by the use of the words “expect”, “anticipate”, “believe", "intend", "estimate", "plan" and similar expressions. Although Saint-Gobain believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions as at the time of publishing this document, investors are cautioned that these statements are not guarantees of its future performance. Actual results may differ materially from the forward-looking statements as a result of a number of known and unknown risks, uncertainties and other factors, many of which are difficult to predict and are generally beyond the control of Saint-Gobain, including but not limited to the risks described in Saint-Gobain’s registration document available on its website (www.saint-gobain.com). Accordingly, readers of this document are cautioned against relying on these forward-looking statements. These forward-looking statements are made as of the date of this document. Saint-Gobain disclaims any intention or obligation to complete, update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

This press release does not constitute any offer to purchase or exchange, nor any solicitation of an offer to sell or exchange securities of Saint-Gobain.

For any further information, please visit www.saint-gobain.com